Outlook 10/01: It's the first week of a new month and a new quarter, which comes with fresh readings on how the U.S. economy performed in September. Today, we'll get the September Markit U.S. manufacturing PMI; the September ISM manufacturing PMI; August construction spending and September auto sales.

The U.S. and Canada forged a last-gasp deal on Sunday to salvage NAFTA as a trilateral pact with Mexico, rescuing a three-country, $1.2 trillion open-trade zone that had been about to collapse after nearly a quarter century.

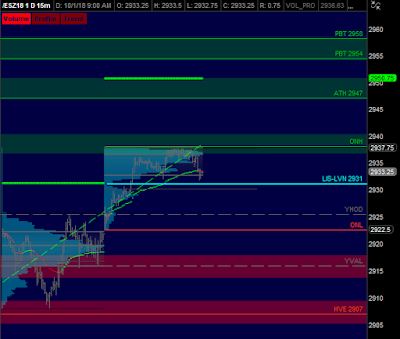

/ESZ8 Value: YVAH 2922 YPOC 2919 YVAL 2916

/ES Plan: On Friday market closed bullish and overnight profile looks bimodal (LIS 2931) moving above yesterday's range, so we've these options:

A) If market remains below above LIS 2931 with bullish internals, try to buy towards ONH 2937.75 ATH 2947 and PBTs 2954-2958.

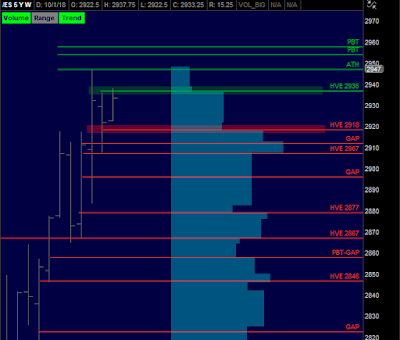

B) If market starts to move below LIS 2931 with bearish internals, become a seller towards ONL 2922.50 GAP 2920.25 and HVE 2877.

Tips: Double digit gap above Friday's close. Gap rules are in play: Larger gaps may not fill on the first day or may do so only partially. Double digit gaps often go nowhere and should be avoided early, because the market tends to chop a lot to digest new levels before moving more definitively later in the session.

Today's Economic Calendar

10:00 ISM manufacturing PMI

10:00 Construction spending

12:15 PM Fed's Rosengren speech

Disclaimer: All information on this outlook is for educational purposes only and is not intended to provide financial advice.

Questions? Just ask via email or twitter @verniman direct message.