Outlook 08/15: U.S. indexes down about 3% on Wednesday, with the SP500 plunging 100 points and suffering its largest decline of the year. Despite the market meltdown, U.S. stock index futures posted solid gains overnight, before turning around on events in Asia. China's finance ministry said it must take necessary measures to counter the latest U.S. tariffs on $300B of Chinese goods, while Hong Kong cut its GDP growth forecast to potentially flat for the rest of the year.

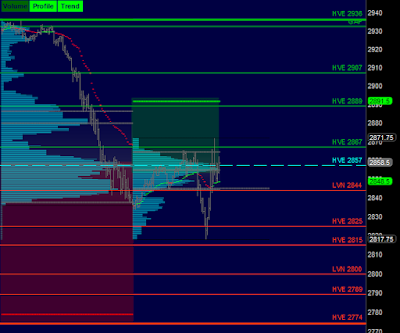

/ESU19 Value: YVAH 2880 YPOC 2857 YVAL 2838 GAP 2840

/ES Plan: Yesterday market closed leaving bearish imbalance (PBT 2780), but overnight looks more bullish (PBT 2891), moving within yesterday's value, so these're the scenarios for today's RTH session:

A) If market moves above HVE 2857 with bullish internals, buy towards HVE 2867 ONH 2871.75 HVE 2889-2907 GAP 2932.25 and HVE 2936.

B) If market moves below LIS 2857 with bearish internals, sell towards LVN 2844 GAP 2840 HVE 2825 ONL 2817.75 LVN 2800 and HVE 2789-74.

When VIX climbs above 20, your first trading rule is 'manage your risk'. When volatility rises and you see a thin order book, I suggest to stay aside until the market recovers a 'normal' negotiable regime. You must know your exit level before your entry.

Today's Economic Calendar

10:00 NAHB Housing Market Index

10:00 Business Inventories

10:30 EIA Natural Gas Inventory

04:00 PM Treasury International Capital

04:30 PM Money Supply

04:30 PM Fed Balance Sheet

Questions via @verniman direct message (RTH) or email (After Close).