Outlook 06/26: U.S. stock futures tick lower as the market seem to have absorbed that the time is not right yet to start lowering interest rates, adding that FED would be open to raising rates again if inflation doesn’t pull back. Traders will shift its attention toward fresh inflation data on Friday with the release of May’s personal consumption expenditures price index. The Federal Reserve keeps a close eye on its preferred inflation gauge, and investors are still hopeful that the central bank will lower interest rates at some point later this year if price increases continue to moderate.

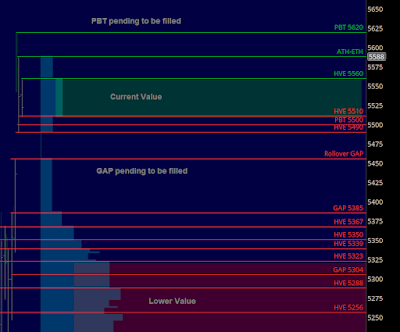

/ESU24 (SEP 2024): YVAH 5534 YPOC 5526 YVAL 5521 GAP 5533.75

/ES Plan: Yesterday market closed balanced, but overnight looks bearish, moving within previous value, so these're the opening and initial balance options for today: