Outlook 08/29: Stock futures rise Thursday, as investors looked to recover from Nvidia shares down 4% after posting its latest earnings Wednesday afternoon. In its fiscal second quarter, the AI chipmaker exceeded expectations on the top and bottom lines, and issued a rosy current-quarter sales outlook. Economic data released Thursday lent support to the stock market. Weekly jobless claims fell from the prior week, further easing recession concerns. In addition, Q2 GDP was revised higher to 3% growth from an initial 2.8% rate.

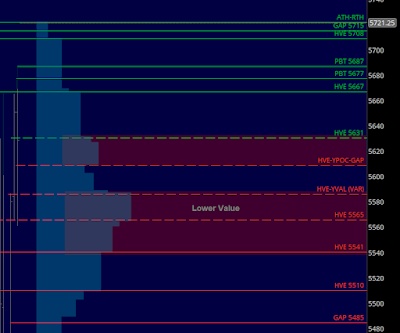

ESU24 (SEP2024): YVAH 5624 YPOC 5609 YVAL 5584 GAP 5606.25

/ES Plan: Yesterday market closed bearish (PBT 5565), but overnight looks more bullish (PBT 5680), moving a few ticks above previous value, so these're the opening and initial balance options for today: