Outlook 10/04: Stock futures tick higher on Friday after the all-important jobs data came in much stronger than economists expected. Nonfarm payrolls grew by 254,000 jobs in September, far outpacing the forecasted gain of 150,000 from economists. The unemployment rate ticked down to 4.1% despite expectations for it to hold steady at 4.2%. Friday’s premarket advances mark a turn after mounting geopolitical tensions in the Middle East gave way to a shaky start in October for stocks. The jobs report appeared to shift investor focus back to the state for the U.S. economy. After a summer of weak labor data readings, this is a reassuring reading that the U.S. economy remains resilient, supported by a healthy labor market.

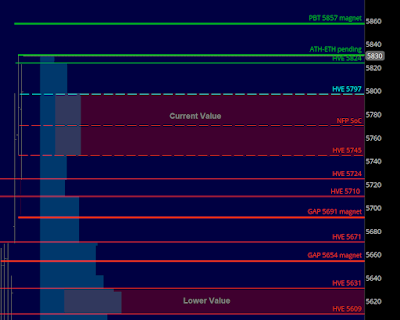

ESZ24 (DEC2024): YVAH 5754 YPOC 5745 YVAL 5736 GAP 5751

/ES Plan: Yesterday market closed bearish, but overnight looks strong bullish, moving above previous value/range, so these're the opening and initial balance options for today: