Outlook: Strong German economic growth data drove the euro to a three-week high and its biggest rise in a month, though it dented European stocks again as they shuffled back to a two-month low. U.S. stock index futures pointed to a mixed opening, with worries about Republican tax plans and the economy's ability to deal with more rises in interest rates preventing sharper gains.

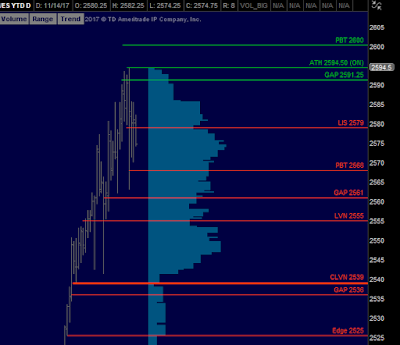

/ES Value: YVAH 2584 YPOC 2582 YVAL 2579

/ES Plan: Yesterday market closed bullish (PBT 2592). Overnight inventory is bearish, moving below yesterday's value, so we've 2 options:

A) If market remains below YVAL 2579 with internals falling, try to be a seller leaning on 2579-2578 towards PBT 2568 GAP 2561 and LVN 2555. Failure to breakdown ONL early is signal of a strength.

B) If market starts to move above YVAL 2579 with internals rising, try to be a buyer leaning on 2578-2579 towards GAP-ONH 2582.25 and YVAH 2584. Failure to take out ONH early is signal of weakness.

Tips: Watching this ON sell off, remember, if the market is moving in one direction, never fade it. Never try to guess the end of a directional move. Wait to see a clear opening range and then observe on which side the main force of the market is playing.

Today's Economic Calendar

11:30 AM 4-week Bill Auction

Link for Updates (Check it during RTH session)

Disclaimer: All information on this outlook is for educational purposes only and is not intended to provide financial advice.

Questions? Just ask via email or twitter direct message.