Outlook: President Trump has landed in Beijing, the third leg of his five-nation Asia tour after stops in Tokyo and Seoul. Major issues that will likely be discussed include North Korea and China's massive trade surplus with the U.S., which reached $26.62B in October.

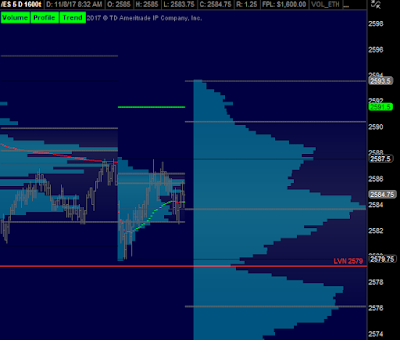

/ES Value: YVAH 2589 YPOC 2584 YVAL 2582.50

/ES Plan: Yesterday market closed leaving bearish imbalance (PBT 2475). Overnight inventory is bimodal, moving within yesterday's value, so as usual we've 2 options:

A) If market remains above YPOC 2584 with internals rising, try to be a buyer leaning on 2584-2585 towards ONH 2587.50 and ATH 2593.50 Failure to take out ONH early is signal of weakness.

B) If market moves below YPOC 2584 with internals falling, try to be a seller leaning on 2584-2583 towards LVN 2579 and PBT 2575. Failure to breakdown ONL early is signal of a strength.

Tips: The pullback to the VWAP is one of the most profitable setup. You need to watch the price action as it is approaching the VWAP. Then wait for a break up/down of the VWAP and then look at the tape action on the time and sales. You will need to identify when buy/sell pressure is spiking and the tape is going crazy. This's more art than science and will require you to practice reading the tape. The goal is to identify when buy/sell pressure is likely to subside and then enter the trade.

Today's Economic Calendar

10:30 AM EIA Crude Inventories

01:00 PM 10-Year Note Auction

Link for Updates (Check it during RTH session)

Disclaimer: All information on this outlook is for educational purposes only and is not intended to provide financial advice.

Questions? Just ask via email or twitter direct message.