Outlook 12/21: Following the approval of a long-anticipated U.S. tax overhaul, lawmakers hope to clear a must-pass spending bill today as the clock ticks toward a potential government shutdown this weekend. Despite the perilous situation, House Republican leaders are still struggling to unite the GOP rank-and-file behind a plan that would push most of their remaining work into next year.

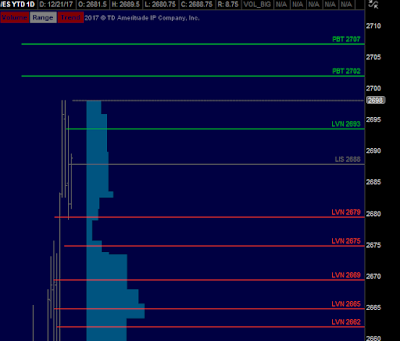

/ES Value: YVAH 2687 YPOC 2685 YVAL 2682

/ES Plan: Yesterday market closed leaving a bearish 'b' shape (PBT 2675). Overnight inventory is bimodal (LIS 2685), moving within yesterday's value, so as usual we've these options:

A) If market remains above YVAH 2687 with bullish internals, try to be a buyer leaning on 2687 towards LVN 2693 ATH 2698 and PBT 2702. Failure to breakdown YVAH early is a signal of a strength.

B) If market starts to move below YVAH 2687 with bearish internals, try to be a seller leaning on 2687-2685 towards YVAL 2682 and LVNs 2679-2675. Failure to take out ONH early is a signal of weakness.

Tips: Watching at the bigger picture, last record high doesn't show decent excess on it. Usually, market needs an excess high to call an end to the current bullish auction. This lack of excess increases the odds that, soon or later, the all time high (ATH 2698) will be revisited.

Today's Economic Calendar

09:45 AM Bloomberg Consumer Index

10:00 AM Leading Indicators

10:30 AM EIA Natural Gas

04:30 PM Money Supply

04:30 PM Fed Balance Sheet

Link for Updates (Check it during RTH session)

Disclaimer: All information on this outlook is for educational purposes only and is not intended to provide financial advice.

Questions? Just ask via email or twitter direct message.