Outlook 03/02: All markets tumble around the globe in the wake of President Trump's planned tariffs on steel and aluminum (25% and 10%, respectively). Stocks in Europe are trading at two-week lows, as the European Commission said it could take the U.S. decision to the World Trade Organization.

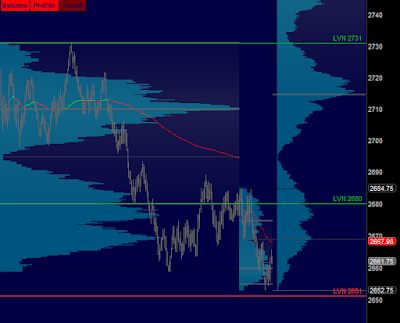

/ES Value: YVAH 2731 YPOC 2710 YVAL 2680

/ES Plan: Yesterday market closed balanced and overnight inventory is bimodal (LIS 2668), so we've these options:

A) If market remains below LIS 2668 with bearish internals, try to be a seller leaning on 2668-2667 towards ONL 2652.75 LVN 2651 and LVN 2620. 'Look below and fail' is a signal of strength.

B) If market starts to move above LIS 2668 with bullish internals, try to be a buyer leaning on 2668-2710 towards GAP 2778.50 ONH 2684.75 and LVN 2731. 'Look above and fail' is a signal of weakness.

Tips: Volatility returns, do yourself a favor and don't try to guess tops or bottoms, just focus on trading what you see.

Today's Economic Calendar

10:00 Consumer Sentiment

01:00 PM Baker-Hughes Rig Count

Disclaimer: All information on this outlook is for educational purposes only and is not intended to provide financial advice.

Questions? Just ask via email or twitter direct message.