Outlook 08/24: FED Chairman Jerome Powell is due to give a speech about monetary policy in a changing economy at the Federal Reserve Bank of Kansas City Economic Policy Symposium in Jackson Hole.

Powell is expected to stay on script for the most part and ignore recent criticism from President Trump in keeping with the tradition of his predecessors. Heading into the Jackson Hole gathering, investors were pricing in a high probability of a rate hike at the FOMC's next meeting in September and a moderate chance for an increase in December.

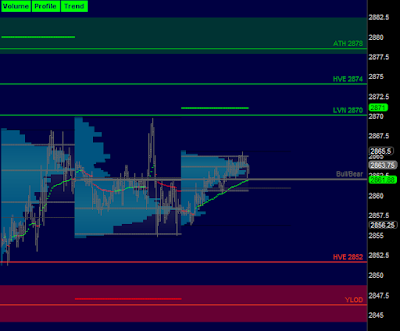

/ESU8 Value: YVAH 2862 YPOC 2858 YVAL 2855

/ES Plan: Yesterday market closed leaving a bearish profile (PBT 2847), but overnight auction became bullish (GBT 2870), moving above yesterday's value, so we've these options:

A) If market remains above YVAH 2862 with bullish internals, become a buyer above 2862 towards ONH 2865.50 LVN 2870 HVE 2874 and ATH 2878. 'Look above and fail' is a bearish signal.

B) If market starts to move below YVAH 2862 with bearish internals, try to lean on 2862 towards GAP 2857.75 ONL 2856.25 and HVE 2852. 'Look below and fail' is a bullish signal.

Today's Economic Calendar

10:00 Fed's Powell: “Monetary Policy in a Changing Economy”

01:00 PM Baker-Hughes Rig Count

Disclaimer: All information on this outlook is for educational purposes only and is not intended to provide financial advice.

Questions? Just ask via email or twitter @verniman direct message.