Outlook 08/29: U.S. stock index futures are continuing a pre-Labor day rally, with the SP500 up by 28 points, as China indicated it wouldn't immediately retaliate against the latest U.S. tariff increases set for Sept. 1. The two countries are also discussing face-to-face talks to be held in the U.S. in September, according to China's Commerce Ministry, which said it's willing to resolve the trade war with a "calm attitude."

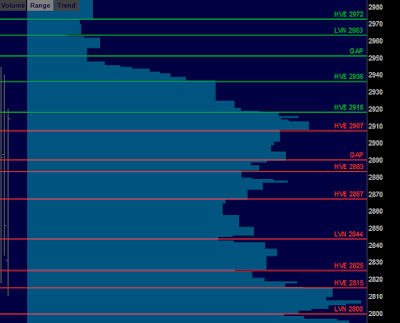

/ESU19 Value: YVAH 2890 YPOC 2885 YVAL 2870 GAP 2890

/ES Plan: Yesterday market closed bullish, and overnight continues on that way, moving above yesterday's range, so today's options:

A) If market remains above LIS 2912 with bullish internals, buy towards HVE 2918 ONH 2919.75 HVE 2936 and GAP 2951.

B) If market moves below LIS 2912 with bearish internals, sell towards GAP 2890 HVE 2883 ONL 2875.25 and HVE 2867.

Tips: Overnight inventory is bullish. The expected action is a counter-auction relative to overnight inventory; failure to see the counter-auction would be an indication of a potential trend day.

Today's Economic Calendar

10:00 Pending Home Sales

10:30 EIA Natural Gas Inventory

01:00 PM 7-Year Note Auction

04:30 PM Money Supply

04:30 PM Fed Balance Sheet

Questions via @verniman direct message (RTH) or email (After Close).