Outlook 09/10: U.S. stock index futures are pointing to bearish open. Markets appear to be moderating their expectations about how much central banks are likely to cut interest rates in the coming days. Treasury yields have come down markedly, lowering borrowing costs for companies and consumers. But will central banks action be enough to avoid the global recession that so many fear? Deutsche Bank says no. Under the assumption of the U.S. and China having irreconcilable differences, Deutsche Bank's view is that a recession is coming.

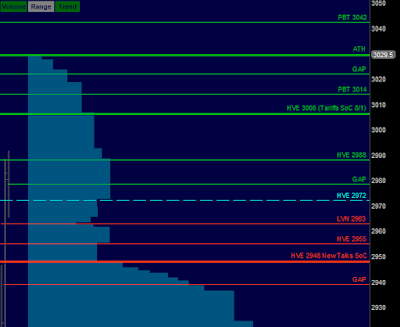

/ESU19 Value: YVAH 2990 YPOC 2985 YVAL 2977 GAP 2978.50

/ES Plan: Yesterday market closed bimodal (LIS 2981) and overnight looks slight bearish, moving below yesterday's value, so these're the options for today:

A) If market remains below LIS 2972 with bearish internals, sell towards ONL 2965.50 LVN 2963 and HVEs 2955-2948.

B) If market moves above LIS HVE 2972 with bullish internals, buy towards GAP 2978.50 ONH 2985 and HVEs 2988-3006.

Note: Apple's annual fall event takes place today in Cupertino (CA), where the tech giant is expected to unveil 3 new iPhones, an updated Apple Watch and more details about Apple TV+. For the first time ever, Apple will stream the event on YouTube at 1PM ET.

Today's Economic Calendar

10:00 Job Openings and Labor Turnover Survey

01:00 PM 3-Year Note Auction

01:00 PM Apple Event

Questions via @verniman direct message (RTH) or email (After Close).

Follow RTH updates using TweetDeck alerts