Outlook 12/09: U.S. stock index futures are suggesting a pause from Friday's job-fueled rally as investors prepare for a series of major risk events later this week. Brexit is on watch ahead of a U.K. general election, a tariff deadline looms with China, and the Fed and ECB will hold their final policy meetings of the year. House Democrats could also vote on articles of impeachment against President Trump, while economic reports will reveal details on consumer prices and retail sales.

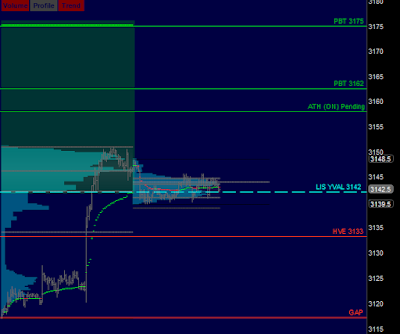

/ESZ19 Value: YVAH 3150 YPOC 3146 YVAL 3142 GAP 3146.50

/ES Plan: Last session market closed bullish (PBT 3175) but overnight looks more balanced, moving within Friday's range, so:

A) If market remains above LIS YVAL 3142 with bullish internals, buy towards GAP 3146.50 ONH 3148.50 ATH 3158 and PBTs 3162-3175.

B) If market moves below LIS YVAL 3142 with bearish internals, sell towards ONL 3139.50 HVE 3133 GAP 3117 and HVEs 3097-3090.

Tips: Remember that new record high printed during ETH sessions should be revisited at NYSE regular trading hours (RTH). Keep in mind that we're on the rollover week, so volume from December 2019 contract starts to dries up towards March 2020 contract.

Today's Economic Calendar

12:30 PM TD Ameritrade IMX

01:00 PM 3-Year Note Auction

Questions via @verniman direct message (RTH) or email (After Close).

Follow RTH updates using TweetDeck alerts