Outlook 02/03: U.S. stock index futures pointed to a balanced open on Monday as Wall Street tried to regain its footing after coronavirus fears sparked a steep sell-off to close out January. The shorter-term uncertainty around the coronavirus is really affecting everything. Stocks in mainland China plummeted overnight in their first session since closing for the Lunar New Year holiday. The Shanghai Composite tanked by 7.7%. The Shenzhen Index fell by 8.4%.

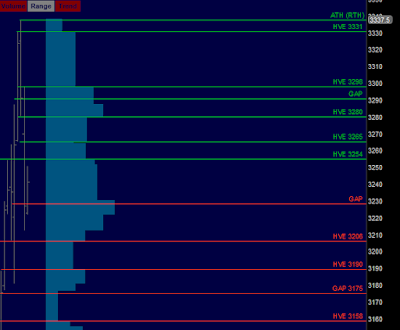

/ESH20 Value: YVAH 3254 YPOC 3227 YVAL 3218 GAP 3228

/ES Plan: Last session market closed bearish but overnight looks more balanced, moving within Friday's value, so these're the options for today's regular trading session:

A) If market moves above ON-VAH 3247 with bullish internals, buy towards ONH 3250.50 and HVEs 3254-3265-3280.

B) If market moves below ON-VAL 3236 with bearish internals, sell towards GAP 3228 ONL 3222 and HVEs 3206-3190.

Note: Overnight inventory is balanced so don't be 'too anxious' to trade early in the morning. If we're within a balanced range we want to have some patience until market bias is defined.

Today's Economic Calendar

09:45 PMI Manufacturing Index

10:00 ISM Manufacturing Index

10:00 Construction Spending

04:30 PM Fed's Bostic Speech

Questions via @verniman direct message (RTH) or email (After Close).

Follow alerts using TweetDeck. Primary twitter language is English.

No unauthorized reproduction of this service without authorization.