Outlook 04/30: Stock futures point to a bearish open after weekly jobless claims hit 3.84 million, topping 30 million over the last 6 weeks. Troubles in the labor market are reflective of a larger slump in economic activity that only recently has been reflected in data. Federal Reserve Chairman Jerome Powell said Wednesday that the unemployment rate is likely to rise above 10% from the March level of 4.4% which counted a period before the intense social distancing policies went into effect. Nonfarm payrolls for April are expected to show a decline of 2.25 million, with an unemployment rate estimates around the 15%.

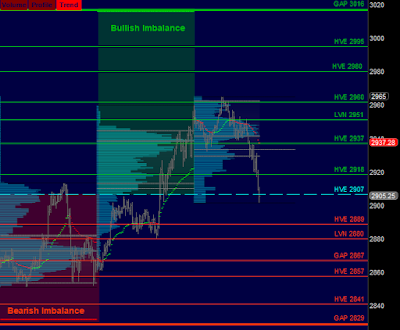

/ESM20 Value: YVAH 2945 YPOC 2938 YVAL 2912 GAP 2940.25

/ES Plan: Yesterday market closed bullish (PBT 3016), but overnight looks more balanced, moving within Yesterday's value, so these are the initial balance options for today's opening:

A) If market remains below LIS HVE 2907 with bearish internals, sell towards HVE 2889 LVN 2880 and GAP 2867.

B) If market moves above LIS HVE 2907 with bullish internals, buy towards HVEs 2918-2937 and GAP 2940.25.

Note: Usually after an overnight sell-off like today, we can expect a counter-trend move after the regular open. Despite of that, double digit gaps rarely get filled on the first day. Don't be anxious and wait for the first clues about the dominant force. Let see.

Market Movers

09:45 Chicago PMI

10:30 EIA Natural Gas Inventory

03:00 Farm Prices

04:30 PM Money Supply

04:30 PM Fed Balance Sheet

Questions via @verniman direct message (RTH) or email (After Close).

Follow alerts using TweetDeck. Primary twitter language is English.

No unauthorized reproduction of this service without permission.