Outlook 09/18: U.S. stock index futures remain cautious ahead of the Fed's interest rate decision today, despite a virtual certainty among investors that policy makers will cut rates by 25 basis points. The Fed is expected to cut interest rates for the second time in a decade, but Fed Chairman Jerome Powell is unlikely to deliver the message markets want to hear on plans for future rate cuts in his 2 p.m. ET statement.

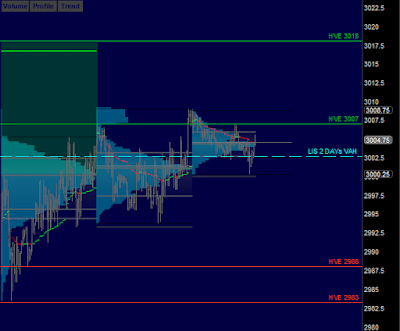

/ESZ19 Value: YVAH 3002.50 YPOC 3001.25 YVAL 2998 GAP 3008.25

/ES Plan: Yesterday market closed balanced and overnight continues sideways, moving above yeterday's value, so today's options:

A) If market remains above LIS YVAH 3002.50 with bullish internals, buy towards GAP 3008.25 ONH 3008.75 and HVE 3018.

B) If market moves below LIS YVAH 3002.50 with bearish internals, sell towards ONL 3000.25 and HVEs 2988-2983-2972.

Note: FOMC day. It’s best to treat FOMC days as two separate sessions. The time before the announcement, which tends to involve a tightening price range and lower activity. Trade setups that work well in the AM, may fail completely in the afternoon, resulting in significant losses. If you've a winner morning, I suggest to avoid FOMC 'cowboy' session.

Today's Economic Calendar

10:30 EIA Petroleum Inventories

02:00 PM FOMC Announcement

02:30 PM Chairman Press Conference

Questions via @verniman direct message (RTH) or email (After Close).

Follow RTH updates using TweetDeck alerts